top of page

Why Multinational Finance Teams Must Monitor Account 473 in Romania

Multinationals risk tax penalties, audit issues, and distorted reporting if account 473 remains unresolved in Romania. Learn best practices for HQ oversight.

Nov 5, 2025

Understanding Tax Advisory Services for Businesses

Navigating the tax landscape in Romania can be complex. Businesses face numerous regulations and frequent changes in tax laws. This makes...

Sep 22, 2025

Monthly Reminder: Submit Accounting Documents on Time

When choosing an accounting firm, it’s important to work with one that follows clear procedures and well-structured processes . This...

Sep 9, 2025

Deadline 18 August: Mid-Year 2025 Accounting Reporting System – Ordinance 1194/2025

Romania’s Ministry of Finance approves Ordinance 1194/2025, setting the mid-year 2025 accounting reporting system for companies with over €1M turnover. Deadline: August 18, 2025.

Aug 15, 2025

Romania Hikes VAT to 21% – Major Tax Changes from August 2025

Romania raises its standard VAT from 19% to 21% on Aug 1, 2025, and unifies the 5% and 9% reduced VAT rates at 11% under new fiscal law 141/2025.

Jul 31, 2025

High Fiscal Risk Criteria Updated in Romania: New Rules from ANAF & Customs

Romania publishes detailed criteria to identify high fiscal risk companies under the Fiscal Code. See who is targeted and how the risk assessment works. High Fiscal Risk Rules for Businesses | ANAF Order 417/2025

Jul 31, 2025

Romania Launches Centralised Sanctions Registry for RO e-Transport

Starting July 2025, Romanian authorities use a centralised registry for sanctions under the RO e-Transport system. Learn how ANAF, Customs and Police apply and update penalties.

Jul 26, 2025

Romania Aligns with CSRD: Law 137/2025 Expands the Role of Statutory Auditors

Romania enforces EU rules on sustainability reporting assurance through Law No. 137/2025. Statutory auditors must now review ESG disclosures under CSRD.

Jul 25, 2025

e-Factura Grace Period Extended for Excise Goods: New Fiscal Amendments in Law No. 138/2025

Romania extends the transitional period for e-Factura and excise product marking through Law No. 138/2025. Learn what it means for your business.

Jul 24, 2025

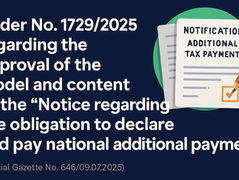

New Reporting Form for National Top-Up Tax Approved by ANAF

Romania’s National Agency for Fiscal Administration (ANAF) has officially approved the model and content of the “Notification on the...

Jul 23, 2025

Romanian Chart of Accounts for NGOs (2025 update)

Romanian chart of accounts for NGOs

Jul 7, 2025

Order 1815/2025: New Customs Laboratory Rules for Sample Analysis

Romania adopts new technical rules under Order 1815/2025 for customs laboratory procedures. Learn what’s analysed, who performs it, and how results are certified.

Jun 19, 2025

RO e-Transport New ANAF Guide: Mandatory GPS Tracking for High-Risk Goods

What Is RO e-Transport? The National Road Goods Transport Monitoring System (RO e-Transport) tracks all domestic and international road...

Jun 16, 2025

New State Aid Scheme Reduces Diesel Excise Duty in Aquaculture Sector

In an effort to support the aquaculture industry, the Romanian Government has adopted Decision no. 511/2025, amending Decision no....

Jun 4, 2025

Validated in Romania: A Business Intelligence App Built to Scale Globally

Piroi | my BUSINESS IN ROMANIA® is a mobile app delivering real-time tax and legislative updates for Romanian professionals. After early traction in the App Store, the team is now opening conversations with international partners to localise the model in other countries.

May 31, 2025

New Reporting Rules for Foreign Oil and Gas Companies Operating in Romania

Romania enforces strict reporting deadlines for foreign companies in the oil and gas sector under Order no. 689/1750/2025. Learn what’s required and how to stay compliant.

May 30, 2025

Does Signing a Superficies Contract Trigger Secondary Office Reporting in Romania?

Learn when Romanian companies must declare a secondary office (=ro. sediu secundar) to ANAF if developing a PV plant under a superficies contract. Avoid fines with expert guidance.

May 29, 2025

Payroll Reporting Rules in 2025

Employers in Romania must comply with new payroll disclosure rules under the updated D112 tax form. These changes affect non-salary income, travel allowances, and vouchers, with clear thresholds and tax implications. Here's what every company must know to avoid fines and recalculations.

May 28, 2025

New 2025 KYC Rules for Crypto, FX, and Real Estate

Law 86/2025 sets new AML rules for crypto, FX bureaus, casinos, and real estate. New KYC thresholds apply. See full changes here.

May 27, 2025

Tax Payment Easements: ANAF Updates Both Classic and Simplified Instalment Procedures

The Romanian tax authority (ANAF) has issued OPANAF no. 597/2025, updating the procedures for granting payment instalments—both classic and simplified—based on multiple amendments to the Fiscal Procedure Code over recent years.

May 26, 2025

New Mobile App: Piroi | my BUSINESS IN ROMANIA®

📲 Piroi | my BUSINESS IN ROMANIA® – Stay ahead with tax updates, expert insights & business tools. Download now on App Store!

May 23, 2025

New Tariff Approved for Electricity Trade with Romania’s Neighbours

Romania sets a regulated tariff of €1.50/MWh (excluding VAT) for electricity exchanges with neighbouring countries, as per Order No. 16/2025.

May 21, 2025

New Reporting Rules for Romania’s Mining Activity Tax

Ordinance No. 241/2025 introduces detailed technical instructions for the registration, reporting, calculation, and payment of mining activity taxes and royalties. Learn what mining license holders must do in 15 days.

May 18, 2025

Romanian Energy Transition Fund Contribution – Reporting Update Effective April 2025

New Reporting Obligation for Energy Market Entities: Energy Transition Fund Contribution from April 2025

May 16, 2025

bottom of page